Where are you going? – have you made a plan yet?

The Governor’s Exit: A Tremor in the Rust of Trump and Tech

On March 5, 2025, Adrian Orr, Governor of the Reserve Bank of New Zealand, announced his abrupt resignation, cutting short a second five-year term that should have carried him to 2028. No reason was given—just a quiet nod to inflation tamed and a financial system still standing after years of turbulence. No mention of the worst recession 1991 was helped create. His departure, effective March 31, isn’t just a personal

What ‘They’ Don’t Tell You: Risk is NOT Volatility.

Risk: What does it really mean, and how much should you take? Risk in Everyday Life vs. Investing Think about the fun, non-financial things you enjoy—fishing, mountain biking, or even crossing the road. Each carries a chance of disaster: a shark attack, a crash, or a rogue bus. Yet, if the odds of total loss are low, we shrug it off—the enjoyment outweighs the danger. Investing, however, feels different. Textbooks,

How WE Become The Bank: The Lightning Network, In Full Effect

Those who know me know that I'm not a fan of sports. In a moment of weakness recently, though, I watched 10 minutes of motorsport with one of my kids. Perhaps because it's pretty simple to understand, I'm happy to allocate a very small amount of my attention to it (and perhaps a bit of sailing). But that's it. So, 10 minutes into watching some very fast cars racing around the

Your Money in a Credit Crisis: Alasdair Macleod

I learnt a lot recently talking to Alasdair Macleod, about a perspective that centers around a systemic failure of the system of credit. What’s credit? Well, if Gold is money and everything else is credit, then effectively all representations of value we can trade outside of Gold is what we’re talking about. Turns out, quit a lot of what we deem ‘wealth’, is in fact a form or derivative of

Will Property Prices Find Their Floor in 2025?

As we stand at the threshold of 2025, the New Zealand property market finds itself at a critical juncture. After weathering a significant storm that saw values plummet by 15-20% from their peak just three years ago, many are wondering: Will the housing market finally find its floor? The property market has been buffeted by a few things, all contributing to a reduction in price. Thrown in CPI inflation of

Intergenerational Wealth, Initiated

Investing is great - over time you'll sort out your retirement. With what you have left, there may even be a little something to leave the kids. That perspective is 100% valid, but for some, they in search of something bigger, something with purpose. This is where setting in motion a strategy of building intergenerational wealth comes in. According to this article quoting the Williams Group Study, which observed 3,250

Why Money’s NOT The Problem – Addiction Is

Wouldn't it be nice to get what we want without selling our soul in the process? In our pursuit of financial success, we often walk a fine line between using money as a tool, and becoming addicted to it in the process. Recently, I've been thinking about this idea of money addiction. Maybe this explains my past financial mistakes, and those of so many else I talk with. I think

2025: The Year of Wealth, Fear, and the Quest for Balance

In 2025 we might see the best investments returns ever. Then again, we may have a total shocker - you never can tell, because most things that dictate returns we can't control, and often the things we can control, we don't. Oh, but that's why it's so much fun! But welcome to '25. I'm writing this in early January, fresh back from a trip up to northern New Zealand

Influence for Sale: Bitcoin, Misinformation, and Central Banking / Daniel Batten

[Opinion] Consider which industry, organisation or commodity, has the most to lose should widespread adoption of Bitcoin occur. I prefer Colonel Mustard, in the Conservatory, with the Candlestick, over the the most obvious shadowy superpowers of centralised authority most likely to blame here, but.... Evidence is now abundantly clear that Bitcoin is more helpful for the environment than harmful, it's not in fact used by criminals [relative to US Dollars],

How to Catch a Good Return in ’25 / Mike Taylor

When putting money in market’s, there’s uncertainty. It’s no wonder some of us look at investing like attending a Casino. It’s at least half true – it’s a game of chance. The other half, of course, is doing everything you can to get lucky. I don’t recall watching much TV as a kid, but I do remember spending a lot of time outside. Either semi-desert alpine Northern America or East

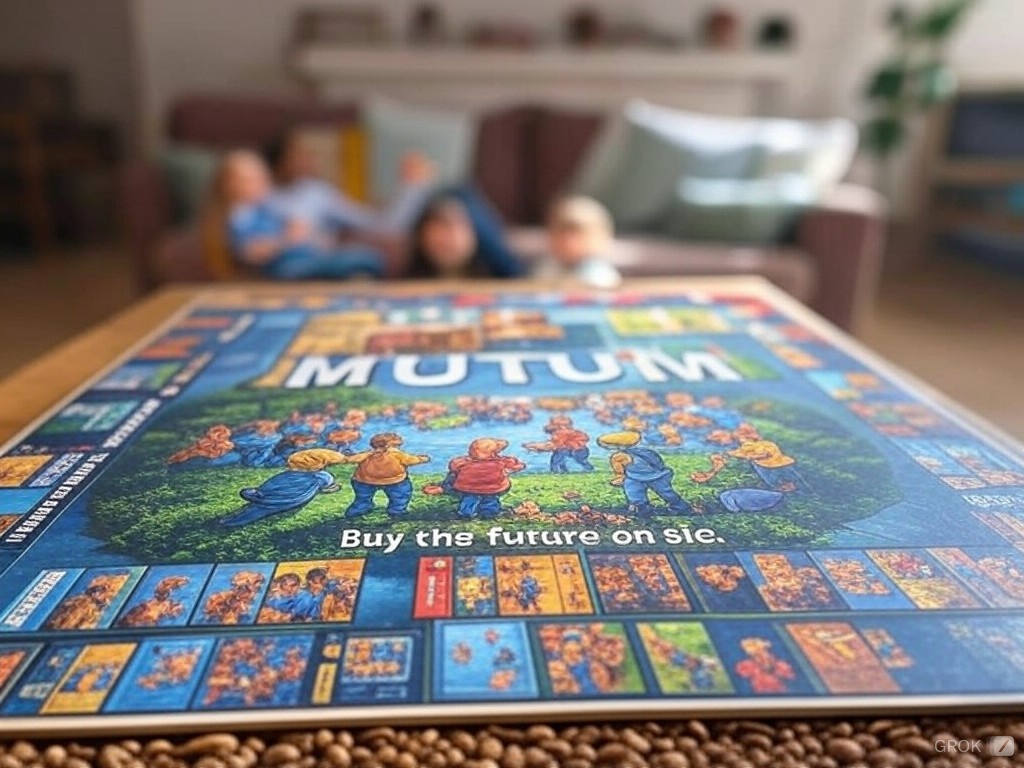

The Palindromic Game: MUTUM

Wise investing isn’t just about growing a pot of money, it’s about solving tomorrow’s needs, at today’s price. It’s about anticipating your future and making some tough choices now to avoid higher costs later. First-time home buyers often purchase ‘first homes’ for example. These are the affordable options that feel safer as a first step. What would happen if they considered the school zones for their future family, though? Avoiding

Bitcoin: This Goes Much, MUCH Higher in ’25

I dragged my eldest kid out fishing recently for some good ol' fashioned father son bonding time. There’s nowhere better to be than on the water. Of course he complained the entire time - bored out of his skull. It didn’t help that the fish weren’t biting, but come on kid, I’m trying to have a Shimano-powered, Norman Rockwell moment over here. But after we finally got our hooks in

Creating Wealth Through Property: The Buy, Hold, Sell Strategy

Success with property requires just 3 moves: Buy, Hold, and Sell. To help with these three moves, we need to study cause and effect within the economy. In other words, the more you can predict what influences inflation, the more you can understand the direction of interest rates, and therefore where property prices may be heading. 1. Buy Timing is Key: Unlike the share market, where it's incredibly difficult to

Big Changes / Big Milestones / Big 2025!

I've been providing financial advice, in some form or another for over 21 years now, and I'm just warming up! Rudolf Steiner was an influential Austrian philosopher, social reformer, and esotericist who lived from 1861 to 1925. He developed a theory of human development based on seven-year cycles, which he believed were linked to astrological influences. I'm not suggesting I adhere to his belief system, but there's something about a

What Happens When Rates Stop Falling?

It’s not difficult these days to research questions around how things work. I recently taught myself how to use diesel fuel mixed with used motor oil to create a great stain for my deck. All by watching a few YouTube videos. It looks great. My wife hates the ‘truck stop’ smell, but there's something satisfying about doing it smarter. You can become a pretty good self-directed investor these days, thanks

This is Personal…

I shouldn't let it get personal, but this time it's different. I’m tired and angry at all the financial pain out there. So many people are doing it tough. The gap between 'haves', and the 'have nots', is the widest I’ve ever seen, and it’s gobbling up vast chunks of 'the middle', too. There’s never enough to solve the problem, because money itself is the problem. It’s just a theory,

Bitcoin: It’s Not For Speculation, It’s For Saving

I realise not everyone has kids, especially around the age where they’re experiencing their firsts, so bear with me and this analogy. I still remember what it was like coaching our newborns through their very first Christmas. They have absolutely no idea what’s going on. The decorations, shrubs inside the house, the freaky old man in a red suit. As the parent, you’re almost going through it on their behalf.

Our Reflexive Response to Bitcoin’s Reflexive Reality

If you're just starting out in your journey, trying to answer 'what is this Bitcoin thing', then this one's for you. Reflexivity in your muscles is like when you accidentally touch something hot — your muscles contract super fast to pull your hand away, keeping you from getting burnt, without you even thinking about it. I once stopped a kid from crossing the road and being run over - my

The Importance of Becoming Your Own Bank

Bitcoin is a form of digital money, which is similar to gold in many ways. One of the most important attributes of Bitcoin is that it affords the holder of it, the ability to become the bank (in a way). There are many benefits to owning Bitcoin, and it’s more than just ‘number go up’. There are some technical steps required to get started, but it’s easier than opening a

When it’s down, it’s time to buy up!

Good news: If you’re looking to buy your first home, or take another step, there are easy times to break in, and we may be in one of them now. Housing downturns, recessions, or economic uncertainty, present ways to climb up the property ladder. The only issue is, not many people take advantage of it. Now before going further, it’s important to acknowledge just how hard it is to get