Wise investing isn’t just about growing a pot of money, it’s about solving tomorrow’s needs, at today’s price. It’s about anticipating your future and making some tough choices now to avoid higher costs later.

First-time home buyers often purchase ‘first homes’ for example. These are the affordable options that feel safer as a first step. What would happen if they considered the school zones for their future family, though? Avoiding the first rung of the property ladder means they won’t have to pay inflated prices for the property they could have purchased today. Or imagine knowing with certainty that one day an inheritance would come through sufficient to fund your entire retirement – could this allow you to spend more time with family today? Whether it’s relationships, family, mental health or net worth, investing for holistic wealth is about prepping for the next stage, before the current stage is over.

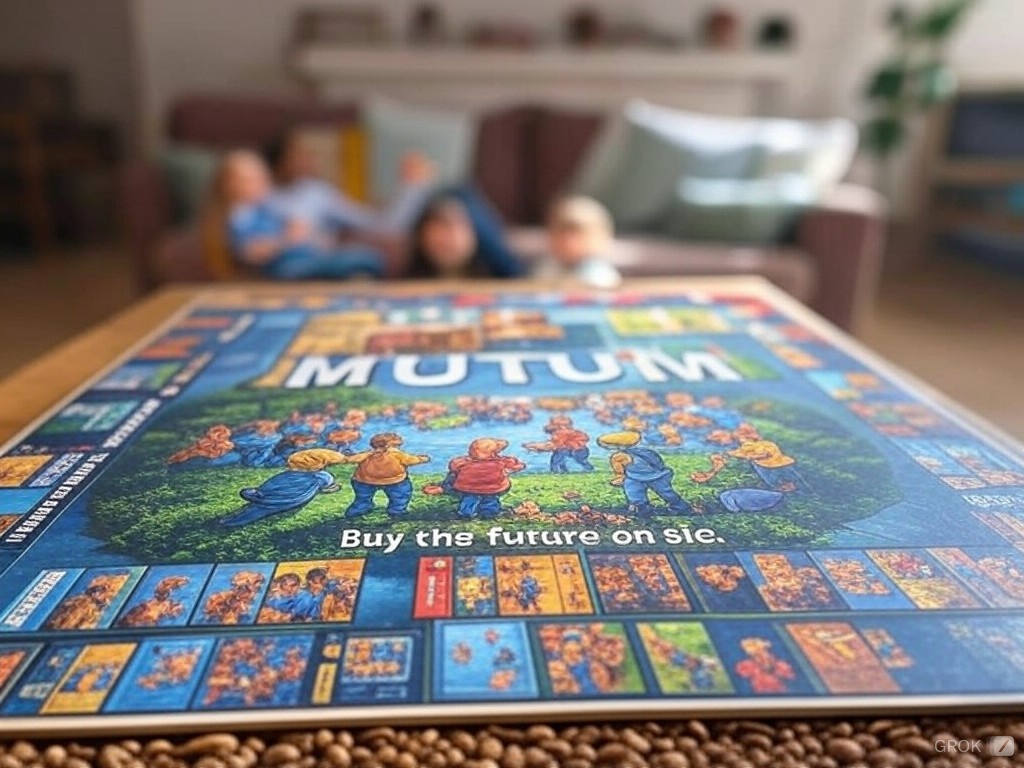

And this is where the palindrome of MUTUM comes in.

It’s a simple, 5-letter acronym that sounds the same forwards or backwards. From the naivety of youth to the wisdom of old age, ‘Me’ ‘Us’ ‘They’ ‘Us’ ‘Me’, is a wealth-building strategy that can help us create better financial outcomes. It works, because it forces us to think ahead.

Let me explain.

We all start at the ‘Me’ stage of life, but occasionally, we fall in love and the ‘Me’ turns into an ‘Us’. ‘Us’, will occasionally produce ‘They’, who turn everything upside down for at least 20 years, then leave home. Then we return to ‘Us’, and hopefully well after retirement, one of us pops our clogs, and it’s back to just ‘Me’ again…And then you die.

To win at the palindromic game of MUTUM, you need to master each of the 5 separate life stages. At each stage, there are tasks, a challenge, and a reward.

Here’s an example:

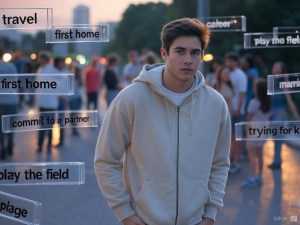

From when we’re born to about 30-35 years old, we’re in the ‘Me’ phase of life. Here are some of the tasks: Try to make grown up decisions like whether to travel or to buy a first home, commit to a life partner or play the field, to get married or try before you buy, or focus on the career vs trying for kids. The challenge: It’ll be far easier having fun compared to making good long-term decisions. The reward: Well begun is half done. Being in the right gear from the start, ensures you won’t stall in life when the pressure comes on.

Within the 30-45 years old range, it’s not uncommon to find the ‘Me’s’, converting to ‘Us’. The tasks: Start a family, complete a family, build a career, buy a larger home, do some reno’s, and keep your relationships healthy. The challenge: If there’s children in the mix, you’re likely doing it all on one income. Also, considering this is the phase of life is most dynamic, some people suffer ‘change withdrawal’ which may lead to change for the sake change, over-trading, or excessive speculation. The reward: A focus on the objectives during this time rather than the events, will help you hang on until things become easier.

Of course there’s no perfect pathway in life, and this is just an example, but there’s a good chance you’re in the ‘They’ life stage between the ages of 40-55 years old – this is when you start having kids. The tasks: Try to enjoy your life, raise successful kids, and work an investment strategy that’ll support you when it’s time to stop trading hours for money. The challenge: You’ll want to give everything you can to your kids and set them up well, but it shouldn’t come at the expense of your future financial security. The reward: You’ll have confidence in your retirement, and in your kid’s ability to stand on their own feet.

Eventually, if you’ve done your job well as parents, when the last kid moves out, the ‘They’ once again becomes an ‘Us’. This often occurs around the 50-65 years old point. The tasks: Get the mortgage gone by the time you finish working, and get as much money saved/invested as you can to create investment income later on. The challenge: Help the kids out with a house deposit and keep adding to the retirement account. The reward: YOU get to spend your money, 100% guilt-free.

From around age 65 onwards it’s time for fun, family, and eventually, a funeral. Now it’s ‘Me‘ again. The tasks: Try not to die, spend time with family, and manage your finances well. The challenge: Find balance between comfort and meaning. The reward: No regrets, a full heart, and an empty bank account.

Obviously real world results will vary and not every journey is the same, but investing isn’t just about growing a pot of money, it’s about collecting a reward throughout each MUTUM life stage. Making the tougher calls and thinking ahead, early on, can make it easier when it comes to the bigger home, giving your kids the best start, and being able to spend freely when you stop work. Addressing the needs of the next stage early on, is like buying the future on sale.

Of course your starting point in life makes a difference too, but so does the quality of decisions you make along the way. Wealth builds up naturally beyond just the financial dimension when you understand and anticipate what occurs in each of the MUTUM life stages. If you learn well how to solve tomorrow’s problems, at today’s price, you’re going to be doing all you can to live a rich life.