So Let It Be Done: Investing in an Age of Absolute Power

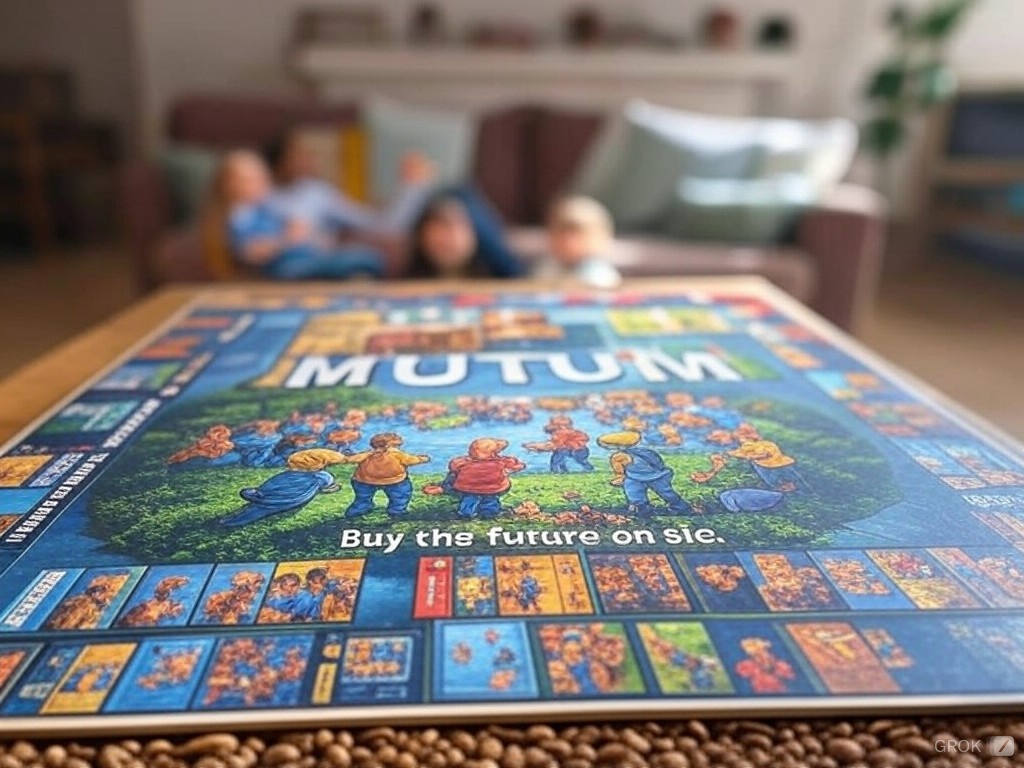

In the 1956 classic, The 10 Commandments, Pharaoh Rameses used the phrase "So let it be written; so let it be done" to assert his absolute power, meaning his decree is law and must be executed. It's tough being a parent who cares about what media his kids consume. Over the past 5 years in